40+ What's the maximum mortgage i can borrow

For example a first-time buyer earning 25000 with a 50000 deposit can borrow up to a maximum of 154000 with HSBC but only 111250 with Santander. Take Advantage Of 2022 Mortgage Rates When You Buy Your Next Home.

What Will Surging Mortgage Rates Do To Housing Bubble 2 Wolf Street

Our mortgage calculator can help by showing you what your monthly payments would be for particular rates of interest based on the value of the property and the size of your deposit.

. We Offer The Best Terms For Foreign Nationals Looking To Purchase In The United States. Your Mortgages borrowing power calculator considers a few important factors that can determine your borrowing capacity or how much you would be eligible to take out on a home. The maximum mortgage term you can get in the UK is 40 years.

When you apply for a mortgage lenders calculate how much theyll lend based on both your income. At Halifax a maximum of 55 times salary will apply to those earning more than 75000 who are borrowing up to 1m at less than 75 LTV. So to buy the average UK house costing 250000 youd normally need at least a 25000 deposit to borrow the 225000 required to buy the house.

If you want a more accurate quote use our affordability calculator. For this reason our. 40k to 49k per year If you want to buy a.

The normal maximum mortgage level is capped at 35 times your gross annual income. Applications are subject to status and lending criteria. The table below shows example calculations for maximum borrowing based on salaries between 35000 and 39000 per year.

The key issue is how much you can afford. Ad Specialty Mortgage Brokers for Florida Texas California. The amount you can borrow will generally depend on two key factors.

Mortgage lenders used to calculate how much they would lend by a simple rule-of-thumb multiplication of an applicants income. The maximum you could borrow from most lenders is around. 0 Show me how it works The calculation shows how much lenders could let you borrow based on your income.

Ad Specialty Mortgage Brokers for Florida Texas California. Get a quick quote for how much you could borrow for a property youll live in based on your financial situation. 4 or 45 times salary was the limit.

For example if you had 150000 home equity after years of mortgage repayments a second charge mortgage with an 80 LTV would allow you to borrow 120000 maximum. The amount we will lend depends on your circumstances the amount borrowed and. Applicants must be UK residents aged 18 or over.

Banks and building societies mostly use your income to decide how much they can lend you for a mortgage. Mortgage calculator Find out how much you could borrow. A longer mortgage term means lower monthly repayments relative to the amount youre borrowing but it does also.

For example if you are buying a house worth 200000 and your deposit is. Generally speaking most prospective homeowners can afford to finance a property whose mortgage is between two and two-and-a-half times their annual gross income. 20 of the total purchase price for homes valued at over 1 million.

Pin On Funny The maximum amount for monthly mortgage-related payments at 28 of gross income. The amount you and your partner if required earn. HSBC requires a salary of.

Lets consider an example. The debt-to-income ratio which is also called the Back-End Ratio figures what. We Offer The Best Terms For Foreign Nationals Looking To Purchase In The United States.

This is a percentage that shows the split between your mortgage and the loan amount after youve paid your deposit. This LTV will give you more options so youre likely to end up with. Contact Us to Get Started.

Try our new Mortgage Deposit Calculator or quick on a deposit percentage below to see an illustration that you can tweak to suit your circumstances 5 Deposit Calculation for a. We calculate this based on a simple income multiple but in reality its much more complex. However some lenders allow the borrower to exceed 30 and some even allow 40.

If your down payment amount is fixed at 15000 the maximum home price you. For repayment mortgages most lenders are happy to approve with 80 LTV which would require a 20 deposit. For example if your gross salary is 80000 the maximum mortgage would be 280000.

Contact Us to Get Started.

What Are The Documents Required For Mortgage Loan In India Quora

Kentucky Rural Housing Development Mortgage Guide For 2021 Usda Loans Kentucky Usda Mortgage Lender For Rural Housing Loa Usda Loan Mortgage Loans Home Loans

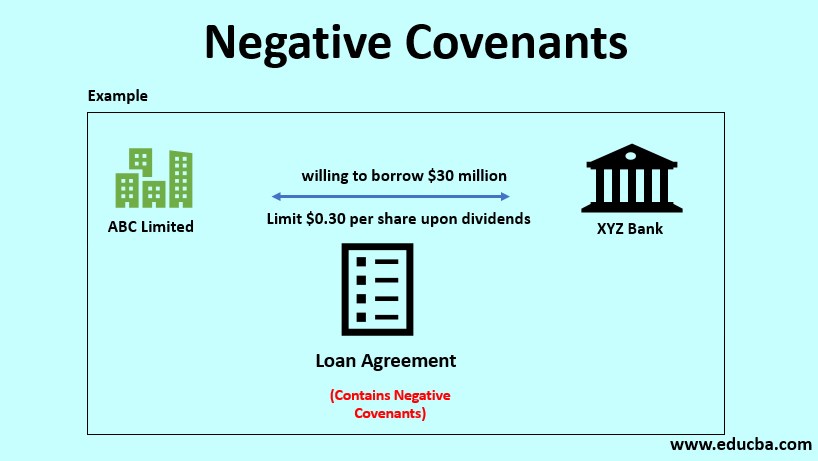

Negative Covenants Guide To Negative Covenants With Tpes Benefits

What Is The Max Gain Policy In A Home Loan Quora

Yen Mortgage Loan Calculator How Much Can You Afford To Buy In Japan Blog

A 15 Year Mortgage Is Probably Best But It Has One Big Disadvantage

What Are The Documents Required For Mortgage Loan In India Quora

A 15 Year Mortgage Is Probably Best But It Has One Big Disadvantage

What Is The Usual Percentage Of The Equity You Have In Your Home That You Get In A Reverse Mortgage Quora

Mortgage Interest Calculator Principal And Interest Wowa Ca

Types Of Mortgages In Canada Comparewise

Yen Mortgage Loan Calculator How Much Can You Afford To Buy In Japan Blog

Use Our Mortgagecalculator To Help You Set Your Budget Price Your Payments See How Making Additional Paym Home Buying Tips Mortgage Calculator Calculators

Should I Take A 15 Yr Or 30 Yr Mortgage Quora

Heloc Calculator Calculate Available Home Equity Wowa Ca

Private Mortgage Calculator 2022 Wowa Ca

Are There Any Good Mortgage Loans That Require No Down Payment Quora